In recent months, the Office of Personnel Management (OPM) had made significant progress in reducing its backlog of retirement claims. However, according to a recent report from Federal News Network, the backlog increased in July, shifting from the positive change earlier this year.

OPM Can’t Keep Up

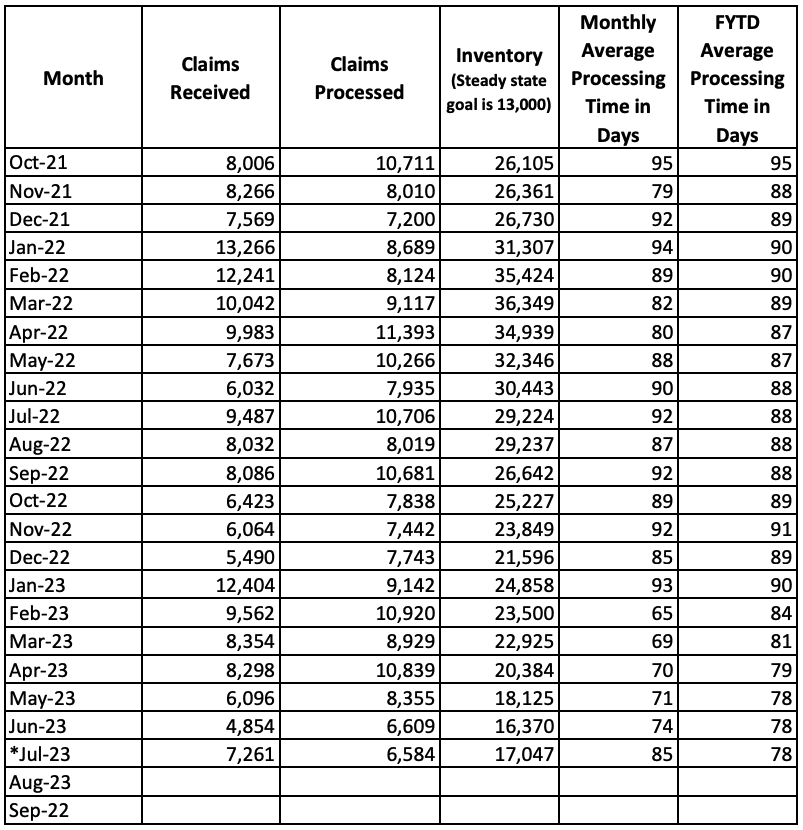

In July 2023, OPM’s retirement claims backlog reversed progress after months of steady reduction. Despite an increase in the number of federal employees filing for retirement compared to June, OPM processed fewer claims, leading to a rise in the backlog. The backlog now exceeds its target goal of 13,000 by more than 4,000.

Increased Processing Time

Another notable statistic from July is the rise in processing times. The average monthly processing time increased from 74 days in June to 85 days in July. Average Processing Time is the number of days between OPM receiving a retirement application through final adjudication (and includes regular and disability retirement). The year-to-date processing time has remained at 78 days since May, though, which is good news since each additional day of waiting can have a significant impact on retirees awaiting their benefits.

The ripple effects of the backlog have the potential to hinder retirement planning for many, as delays and inefficiencies can impede a smooth transition into retirement for federal employees.

Legal Representation Matters

If you are thinking of applying for Federal Disability Retirement, Harris Federal has helped more than 8,000 federal employees secure their benefits. Our firm will guide you through the process, making it simple and clear, and will stay on top of your case throughout any long processing times.

While there are no legal avenues to speed up processing times, having a solid application the first time you apply is imperative to making this process as quick as possible.

We represent federal employees at a 99% success rate and are ready to learn more about your case.

Click to schedule a free consultation with Harris Federal to learn how we can help you.