Everyone looks forward to retirement, and for some, it may not be that far off. Working in the federal government, you have a few retirement options available to you, each with different age and service requirements. However, if you are worried about reaching your age and service requirements due to a disability, there is a benefit hidden in your FERS package called Federal Disability Retirement that would allow you to retire NOW.

In this article we will cover the main retirement options that may be available to you, to help you better plan for your future.

Immediate Retirement Options

If you have been working for the federal government for a while and are looking to retire, you may be eligible for immediate retirement. There are three main immediate retirement options from the federal government:

- Minimum Retirement Age (MRA) +30 Years of Service

- Age 60 with 20 Years of Service

- Age 62 with 5 Years of Service

If you choose any of these options, you will receive an immediate full annuity. Your annuity will be calculated using your high 3 average and your creditable years of service. If you have more than 20 years of service at retirement, you will receive 1.1% of your high 3 average for every year of service. If you have less than 20 years, you will receive 1% of your high 3 average for every year of service.

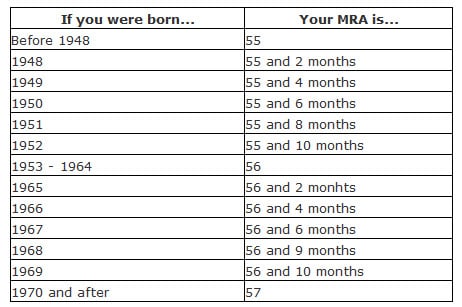

Your minimum retirement age is based on the year you were born. You can find your MRA on this chart from the OPM-

Early Retirement Options

If you are looking to retire early from your federal position, there are two main options available.

- MRA +10

- Federal Disability Retirement

An MRA +10 retirement would allow you to retire early at your minimum retirement age plus 10 years of creditable service. If you choose this option, however, your annuity will be reduced. For every year that you are under age 62, your annuity will be reduced by 5%.

Federal Disability Retirement would allow you to retire immediately while receiving a monthly annuity until you turn age 62. At age 62, you will receive your regular retirement annuity. This is a great benefit if you have a medical condition that is preventing you from fully performing your job, and it allows you to maintain your retirement benefits. If you are struggling in your federal position, contact our firm to see if you qualify!

Both MRA +10 and Federal Disability Retirement are great options for early retirement from the government. Which option is best for you depends on your specific situation and plans for retirement.

Special Provisions Retirement

If you are in a special provisions position, like a federal law enforcement officer, air traffic controller, or federal firefighter, your retirement requirements will differ slightly. Special provisions positions are considered high-risk positions and therefore receive a higher retirement calculation and mandatory retirement ages.

Special provisions employees have a mandatory retirement age of 56 or 57 and can retire at age 50 with 20 years of service or any age with 25 years of service.

Your special provisions retirement will be calculated at 1.7% of your high 3 average for your first 20 years of service, and 1% of your high 3 average for any years after 20.

Retirement can be an exciting time, it’s a chance to start a new life or even find a new passion. But it’s also important to financially plan for retirement in order to be prepared for anything life throws your way.

Retiring from the federal government doesn’t have to be complicated. There are a few options available that will allow you to retire and start a new chapter in your life.